If you’re into 3D printing, Rachel Park doesn’t need an introduction. As a journalist, she covered the 3D printing and additive manufacturing sector since 1996. She led 3D Printing Industry as Editor in Chief and also edited Disruptive Magazine for 3D Printshow. Currently, Rachel works as an independent freelance journalist and runs her own copywriting and editing company.

What if 3D Printing turns your Business World Upside Down and your Tax Profile Inside Out?

“In this world, nothing can be said to be certain, except death and taxes.”

The above is a familiar quote by Benjamin Franklin, spoken, in truth, slightly less that 300 years ago. Today it’s become a bit of a cliché – but then truth often does. I know taxes have made me cry, particularly at the end of a year, and I know the time is approaching to deal with THAT government form again!

Fairness (or lack thereof) in taxation systems is another matter entirely, one I will not rant about here, but I have been fascinated to read the work of Channing Flynn recently who has drilled down into the murky waters of how taxation will be affected by the evolving 3D printing industry. I freely admit, while I’ve reluctantly thought about taxes and actively think about 3D printing on a daily basis, I have never considered the inter-relation of these two issues — until now.

Mr. Channing Flynn is the Global Technology Industry Leader for the Tax Services division at Ernst & Young, the business consultancy firm. He put out a report last year called 3D Printing Taxation Issues and Impacts, which you can find in full here.

More recently, just last week in fact, he wrote a piece for the Harvard Business Review (HBR) on this issue, slightly more broad in nature, called The Questions Executives Should Ask About 3D Printing. This piece, while broader but shorter in nature than the original report it draws from, does home in on taxation issues, it being his specialty and all, but the points he raises are indeed germane to anyone with a commercial interest in the future of the 3D printing industry.

Changing Business Models and Disruptive Technologies have Always Complicated Tax Issues

Flynn cites some of the problems that many tax authorities face currently with the emergence and strengthening of the digital economy particularly pertaining to changing business models — he rolls this out further and poses there are more problems ahead as new technologies, specifically 3D printing, permit localized manufacturing.

To provide some context, Flynn does state upfront that 3D printing is not mature enough yet to glean all the answers, but that it is not too early to understand the disruptive nature of the tech and to pose the questions and start planning accordingly.

The main questions he poses about 3D printing that will complicate tax issues (like they weren’t complicated enough already) centre around where the value of a product lies (ie. in its physical or digital form) and the changing nature of the traditional manufacturing supply chain, which includes the slow but increasing trend towards localized manufacture.

In terms of Intellectual Property (IP), Flynn expects that the value of a product’s underlying IP will overtake its actual production value as the costs of making it (and transporting it) come down over time by way of processes like 3D printing. Thus, he suggests that it is “how and where 3D IP is owned and authorized for use will be critical to business relationships and the characterization of the income derived from [it].” This is not the first time IP has emerged as a thorny issue for companies utilizing 3D printing of course — piracy and ownership have been debated for what seems like a long time now — but it is the first time I’ve been aware of it challenging finance divisions and their tax calculations.

It is also the financial officers, according to Flynn, that have to get to grips with the cost — and tax — implications of a company’s supply chain. He cites the “need to adjust intercompany cost-sharing of taxable functions, risks, and assets” every time the supply chain changes and believes that 3D printing will change existing supply chain models significantly. I believe he really is on to something here, in fact, there is plenty of evidence to illustrate that it is already happening and will likely only increase.

Things will Start to Change When 3D Printing Brings Loss To the Authorities

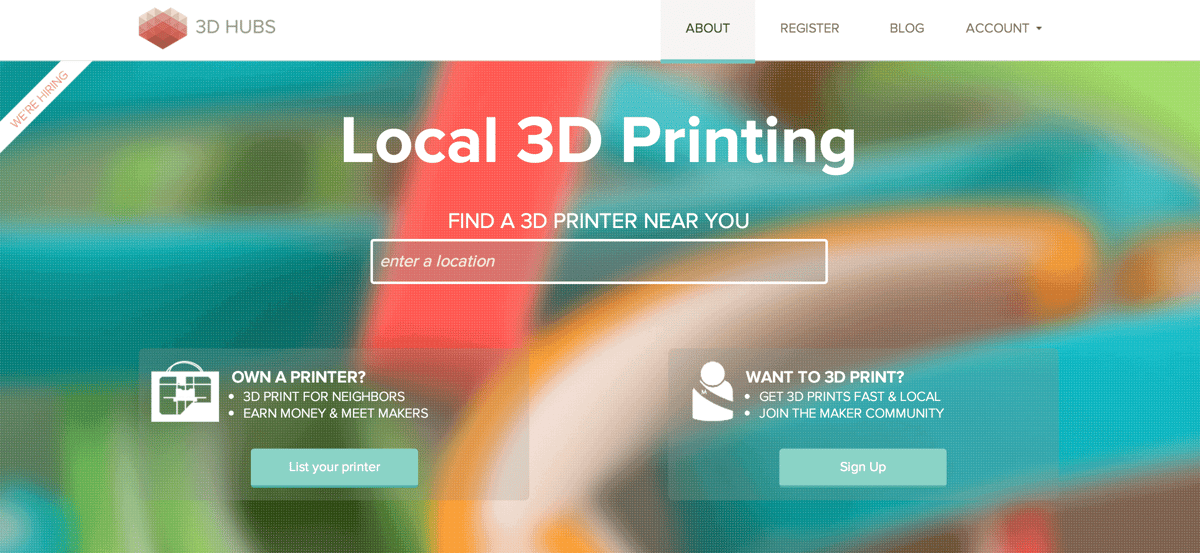

While I would contend his future view of consumers 3D printing what they need when they need it themselves — the implications he puts forward are just as relevant for local 3rd parties or localized manufacturing centers (think 3D Hubs and Local Motors respectively), where I do see huge growth potential. Thus, poses Flynn, the growth of these types of business models will have a direct impact on customs duties and VAT/GST. 3D printing business models, as named above, demand that 3D printers, raw materials, and digital files are likely to still cross borders and incur customs charges, however, it greatly reduces the flow of the actual products with intrinsic value. Will it bring a loss to the authorities? Almost certainly over time and they will look to plug the hole somewhere — likely from the digital format and companies need to be prepared.

As usual, there are no definitive answers and no comprehensive solutions. But Flynn’s work does throw up some valuable insight, and I highly recommend reading it in full if you get the chance.

However, to combat the inevitable headache that thinking about taxes brings on — I’m going to finish with a bit of whimsy — another life lesson from Mr. Franklin … only relevant due to the tenuous link of authorship; but, it is wholly appropriate to anyone working in the 3D printing industry right now — and anyone that isn’t.

“Tell me and I forget. Teach me and I remember. Involve me and I learn.”

License: The text of "3D Printing Will Turn Tax System Upside Down" by All3DP is licensed under a Creative Commons Attribution 4.0 International License.